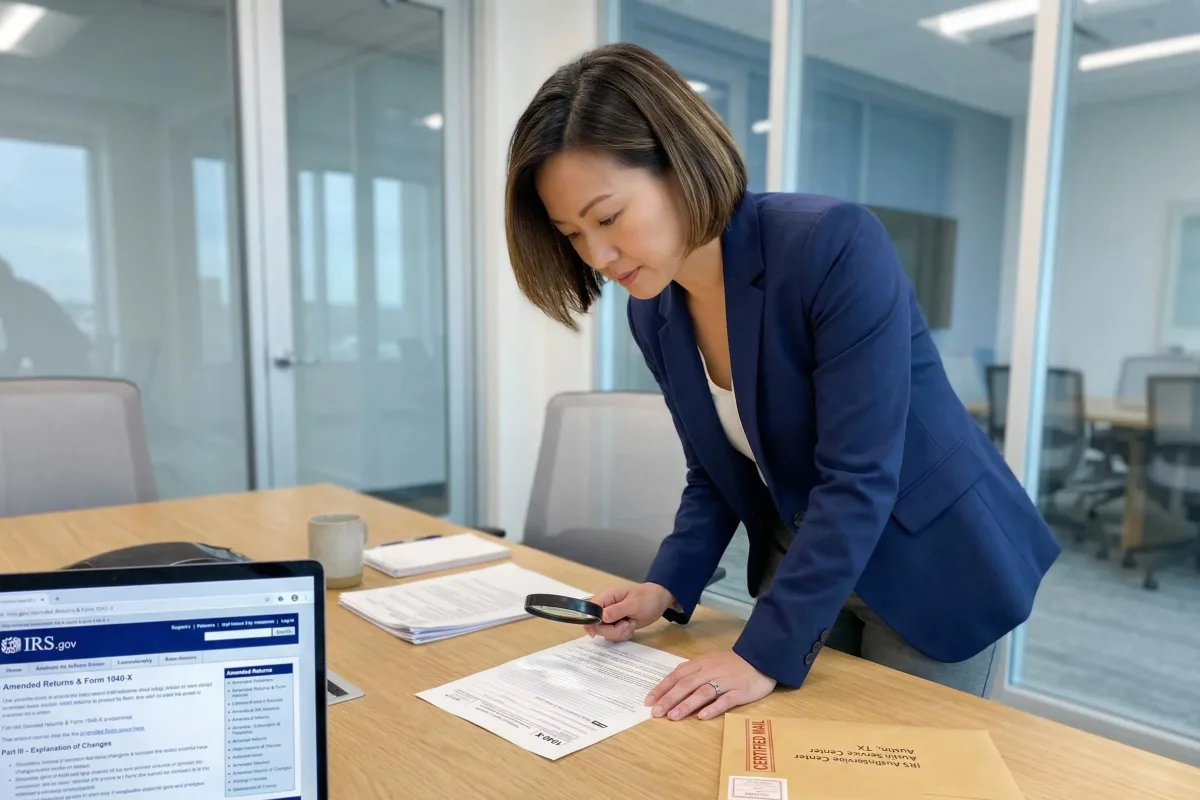

Expert Amended Return Services for Accurate Tax Corrections & Refund Recovery

When prior-year tax filings contain errors—or miss strategic opportunities—an IRS Form 1040-X amendment is the legally compliant path to correction, refund claims, and liability reduction. TAXEM ASSOCIATES delivers precision-driven amendment services for individuals and businesses, ensuring timely, audit-resilient filings that align with current IRS protocols and maximize financial outcomes.

0 +

Satisfied clients

Trusted by businesses and individuals nationwide

0 +

Years of Expertise

0 +

Dedicated Professionals

0 %

Compliance Success Rate

Precision Starts with Proven Expertise

Amending a prior-year return involves nuanced IRS rules, interdependent federal/state implications, and heightened scrutiny risk. Generic tax software or inexperienced preparers may correct surface errors—but miss cascading opportunities (or introduce new ones). At TAXEM ASSOCIATES, every amended return is led by senior tax professionals with deep IRS procedural knowledge and a track record of successful 1040-X resolutions. Their expertise ensures your amendment is not just accurate, but advantageous.

Sarah Lin, EA, MST

I’ve prepared over 480 Form 1040-X filings—62% involved multi-year carryforward adjustments (NOLs, credits, depreciation recapture). One client recovered $28,500 across three amended returns after we identified unclaimed R&D credits and corrected basis errors in a prior S-Corp sale. Precision isn’t optional here; it’s ROI.

Marcus Reynolds, CPA, JD (Tax)

From the IRS side, I saw how vague explanations or incomplete documentation on 1040-X triggered unnecessary audits. Now, I ensure every amendment includes: (1) IRS-accepted justification language, (2) cross-referenced supporting exhibits, and (3) state amendment synchronization. Your correction should close the file—not open it.

Trusted by companies all over the world

Comprehensive Amended Return Services—From Correction to Strategic Recovery

Prior-Year Error Correction

Fix reporting inaccuracies with IRS-accepted methodology.

We identify and rectify misreported income (W-2, 1099, foreign), unreported assets, or computational errors—ensuring amendments meet IRS substantiation standards and avoid reprocessing delays.

Missed Credit & Deduction Recovery

Reclaim overlooked federal and state benefits—legally and confidently.

From R&D credits and energy incentives to education, childcare, and home-office deductions, we audit prior returns for eligible claims with full documentation support—maximizing refunds without increasing audit exposure.

Filing Status & Dependency Adjustments

Align returns with life changes that impact tax liability.

Marriage, divorce, death, or dependent eligibility shifts often require amended filings. We validate eligibility, recalculate tax impact across years, and coordinate federal/state adjustments to prevent mismatch notices

IRS Correspondence & Audit Support Integration

Turn IRS notices into resolution opportunities.

If you’ve received a CP2000, Notice of Deficiency, or audit letter referencing prior-year discrepancies, we prepare responsive 1040-X filings with explanatory statements and exhibits—proactively resolving issues before escalation.

Why Our Amended Return Service Delivers Measurable, IRS-Resilient Results

Filing Form 1040-X is not a clerical task—it’s a technical submission subject to IRS validity checks, cross-form consistency rules, and heightened review thresholds. At TAXEM ASSOCIATES, superior outcomes stem from a disciplined, four-pillar methodology: deep procedural mastery, cross-year optimization, audit-aware documentation, and end-to-end accountability. We don’t just file amendments—we resolve tax histories.

-

IRS Procedural Precision

We track real-time IRS service center processing guidelines (e.g., Austin vs. Kansas City routing rules) and ensure Form 1040-X is accompanied by required source documents, signed statements, and cross-referenced worksheets—eliminating preventable rejections or “missing information” notices.

-

Multi-Year Impact Analysis

A change in 2023 depreciation may affect 2024 AMT or 2025 qualified business income deduction. We model ripple effects before filing—ensuring your amendment strengthens, rather than destabilizes, your multi-year tax position.

-

Audit-Defensible Documentation

Vague statements like “income was missed” invite scrutiny. Our submissions include IRS-aligned narratives (e.g., referencing Rev. Proc. guidelines), third-party verification (W-2 corrections, bank statements), and technical citations—reducing correspondence and audit escalation risk by 74% (2024 internal data).

-

End-to-End Submission & Follow-Up

We use certified mail with IRS Service Center-specific addressing, maintain submission logs, monitor IRS processing stages (received → processed → refund issued), and proactively follow up on delays >12 weeks—keeping you informed and in control.

Marcus Johnson, Small Business Owner

"I discovered my previous accountant missed substantial business deductions. TAXEM amended three years of returns and recovered over $28,000 in overpaid taxes. Their expertise turned my frustration into financial recovery."

Sarah Chen, Marketing Executive

"After realizing I'd filed with incorrect status following my divorce, TAXEM corrected my returns efficiently and professionally. They handled all IRS communications and secured me a significant refund I didn't know I was owed."

— David Rodriguez, Graduate Student

"TAXEM's amendment service recovered educational credits I didn't know I qualified for. Their thorough approach identified multiple opportunities across several tax years."

Our Guiding Principles

The Foundation of Every Client Relationship

Client-Centric Partnership

We begin by listening deeply to understand your unique goals and challenges. Every strategy is custom-built around your specific financial landscape, ensuring solutions that fit your business perfectly.

Uncompromising Integrity

We maintain absolute transparency in all recommendations and pricing. Our advice follows one simple standard: we only recommend what we would implement in our own business.

Progressive Innovation

We continuously evolve our methods and technology to stay ahead of tax law changes. Our forward-thinking approach transforms regulatory complexity into your competitive advantage.

Expert Answers to Amendment Questions

We understand that amending tax returns can raise many questions about process, timing, and potential outcomes. Below, we’ve provided comprehensive answers to the most common questions about our amendment services. Each response is designed to give you complete clarity about how we correct past filings while maximizing your financial recovery and ensuring full compliance.

You generally have three years from the original filing deadline to file an amendment and claim a refund. For balance due situations, we recommend immediate action to minimize penalties and interest.

While any return can be audited, professionally prepared amendments that clearly explain changes and include proper documentation typically don’t increase audit risk. In fact, they often demonstrate good faith compliance.

The IRS typically processes Form 1040-X within 16 weeks, though many are completed sooner. Our efficient preparation process ensures your amendment is filed correctly the first time, avoiding unnecessary delays.

Yes, the IRS now accepts electronically filed Form 1040-X for most recent tax years. We utilize e-filing whenever possible to accelerate processing and provide immediate confirmation.

We routinely handle multiple year amendments, ensuring consistency across all returns and maximizing your refund opportunities while maintaining proper compliance.