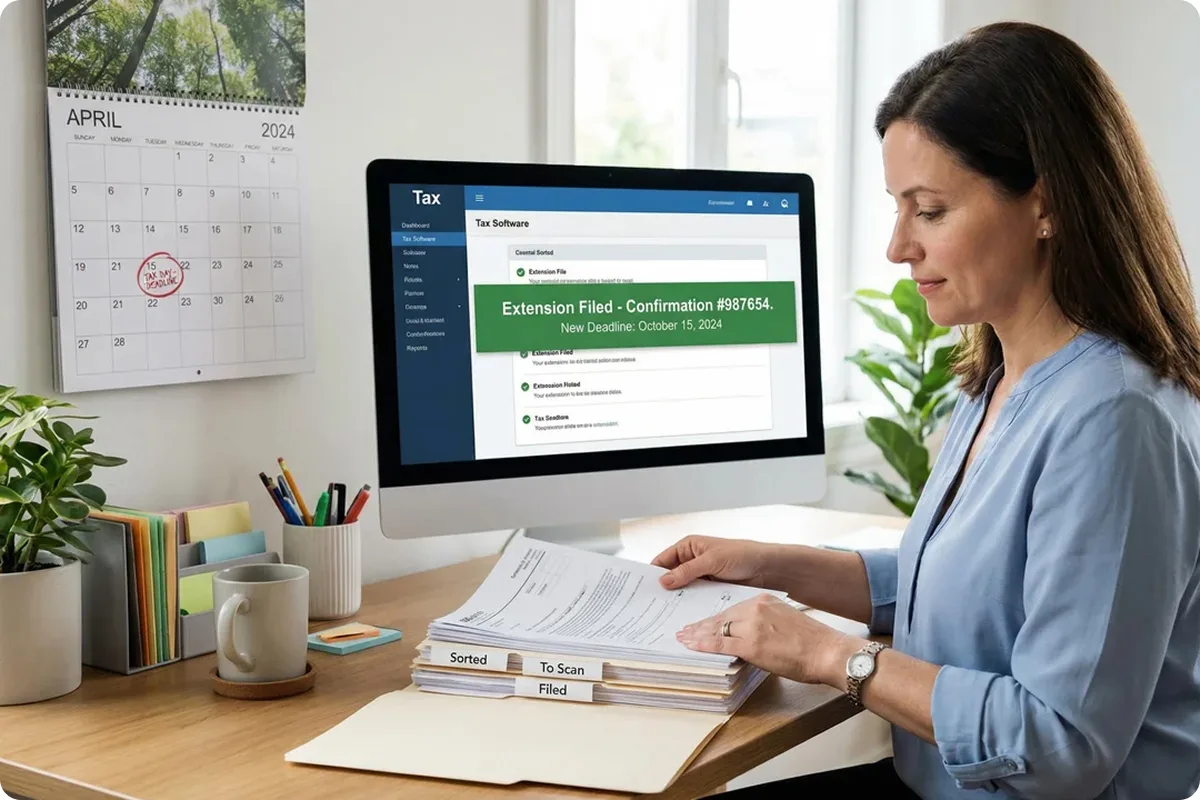

Secure More Time Without the Stress

Need extra time to file your taxes? We make filing for an extension simple and stress-free. Get an automatic 6-month filing extension while avoiding costly late-filing penalties. Our experts handle all the paperwork so you can focus on preparing your accurate, complete return.

0 +

Satisfied clients

Trusted by businesses and individuals nationwide

0 +

Years of Expertise

0 +

Dedicated Professionals

0 %

Compliance Success Rate

Architectural Approach to Extension Filing

Strategic extension filing requires understanding both IRS procedures and the underlying reasons for needing additional time. While many view extensions as a last-minute emergency measure, we approach them as strategic tools that enable thorough preparation and optimal financial outcomes. At TAXEM ASSOCIATES, every extension filing is managed with the same precision as final tax preparation, ensuring not just extra time but strategic advantage in your tax planning process.

Jennifer Martinez, EA Senior Tax Specialist

“I’ve managed over 800 extension filings for both individuals and businesses, with approximately 40% involving complex multi-state considerations. One client avoided $18,000 in late-filing penalties through our strategic extension approach coupled with accurate payment estimates. Proper extension filing isn’t about delay—it’s about creating space for accuracy.”

David Chen, CPA Tax Compliance Director

“Having worked with clients through numerous tax seasons, I understand how rushed filings lead to errors and missed opportunities. Our extension process includes: (1) Accurate payment calculations to avoid penalties, (2) Multi-state coordination, and (3) Seamless transition to final filing. The goal is compliance without compromise.”

Trusted by companies all over the world

Complete Extension Filing Solutions

Automatic Extension Filing

We prepare and file IRS Form 4868 for individuals or Form 7004 for businesses, securing your automatic 6-month filing extension with guaranteed acceptance.

Tax Payment Estimation

Accurate calculation of any estimated tax due to help you avoid underpayment penalties while maintaining compliance.

Multi-State Extension Coordination

Handling of all required state extensions to ensure complete protection across every jurisdiction where you file.

Filing Deadline Management

Complete tracking of your new October 15th deadline with proactive reminders and seamless transition to final return preparation.

The TAXEM Extension Advantage

Filing a tax extension shouldn’t just be about buying time—it should be about creating strategic advantage. Our extension service goes beyond simple form preparation to deliver comprehensive protection and peace of mind. We transform what many see as a last-minute emergency into a strategic financial decision that protects your interests while ensuring complete compliance. Our systematic approach ensures you not only secure the extra time you need but do so in a way that optimizes your overall tax position and minimizes any potential penalties.

Michael Chen, Business Owner

"I was overwhelmed with a business acquisition and missed the tax deadline. TAXEM filed my extension in hours and saved me from $5,000 in late-filing penalties. Their guidance on estimated payments was spot-on."

Sarah Johnson, Freelance Consultant

"As a freelancer with unpredictable income, I often need extra time to gather all my documents. TAXEM makes extension filing so simple and affordable—it's become an essential part of my financial routine."

David Park, Healthcare Professional

"When a family emergency derailed my tax preparation, TAXEM's urgent extension service was a lifesaver. They filed same-day and provided crystal-clear next steps for my situation."

Our Guiding Principles

The Foundation of Every Client Relationship

Client-Centric Partnership

We begin by listening deeply to understand your unique goals and challenges. Every strategy is custom-built around your specific financial landscape, ensuring solutions that fit your business perfectly.

Uncompromising Integrity

We maintain absolute transparency in all recommendations and pricing. Our advice follows one simple standard: we only recommend what we would implement in our own business.

Progressive Innovation

We continuously evolve our methods and technology to stay ahead of tax law changes. Our forward-thinking approach transforms regulatory complexity into your competitive advantage.

Clear Answers About Extension Filing

Navigating tax extensions can raise important questions about process, timing, and implications. We’ve provided comprehensive answers to the most common concerns about extension filing to give you complete confidence in using this strategic IRS-approved option. Each response is designed to address both immediate practical concerns and longer-term planning considerations.

No. Extension filing is a routine, automatic IRS procedure that doesn’t raise audit flags. Millions of taxpayers file extensions each year without any increased scrutiny.

Yes. An extension gives you more time to file, not more time to pay. We’ll help you estimate any taxes due and provide payment options to avoid late-payment penalties.

We can typically file your extension within 1-2 business hours for standard situations, or immediately for urgent needs. Electronic filing provides instant IRS acceptance.

We handle all state extension requirements concurrently with your federal extension, ensuring complete protection across every jurisdiction where you have filing obligations.

Yes! Filing an extension automatically extends your IRA contribution deadline to October 15th, giving you extra time to maximize your retirement savings.